What Does ABSA Credit Card Travel Insurance Cover?

Planning a trip abroad? It's exciting, but also important to make sure you're covered for the unexpected. If you're an ABSA credit card holder, you might already have some travel insurance without even knowing it!

When you buy your international return flight tickets using a qualifying ABSA credit card, you automatically get basic travel insurance for journeys lasting up to 90 days. This cover generally includes emergency medical expenses and personal accident benefits, giving you peace of mind while you explore new places.

But what does this "automatic basic cover" actually mean for you? Let's break it down.

What ABSA Credit Card Travel Insurance Generally Covers

ABSA's automatic basic travel insurance is designed to help with some of the main worries when you travel overseas. Here's a quick look at what's usually included:

- Emergency Medical Help: If you get sick or have an accident while you're away, this cover helps with doctor visits, hospital bills, and even getting you home if it's medically necessary. I remember my cousin had a nasty fall in Thailand once, and their credit card travel insurance was a lifesaver for the hospital bills. It really showed me how important it is to have that safety net.

- Personal Accident Protection: This part offers some financial help if something serious happens, like a permanent disability or, in the worst case, death.

- Travel Assistant Service: You get access to a 24-hour helpline. They can help with things like sending urgent messages, giving legal advice referrals, pointing you to your embassy, or helping if you lose your passport or need emergency travel arrangements.

This basic cover usually applies to travellers aged between three months and 74 years old.

It's important to remember that this automatic insurance is basic. It generally doesn't cover any medical conditions you had before your trip, and some risky activities might not be included.

Getting More Covered: Top-Up Options

Sometimes, the basic cover might not be enough for your specific trip. Maybe you have a pre-existing medical condition, or you're planning an adventurous holiday. ABSA offers optional "top-up" cover that gives you more protection.

With top-up cover, you can add benefits like:

- Trip Cancellation or Shortening: If you have to cancel your trip or come home early due to unforeseen events.

- Lost or Stolen Baggage: Cover for your belongings if they go missing or are stolen.

- Lost Money or Passport: Helps out if your cash or important documents disappear.

- Personal Liability: Protects you if you accidentally cause harm to someone or damage their property.

- Legal Help: Covers legal expenses and advice if you need it while overseas.

I once had a scare where my luggage was delayed for a day on an international flight. Thankfully, it turned up, but it really made me think about how much easier it would have been if I had comprehensive baggage cover from the start. It’s those little things that can cause big headaches.

If you're a senior traveller, between 75 and 85 years old, ABSA also has special travel insurance packages. There's even exclusive cover for those aged 86 to 89, though it comes with specific requirements like medical clearance.

To ensure you're fully prepared for your international adventure, you should also remember to activate your ABSA credit card for international use before you go.

Before you travel, always make sure to get your travel insurance certificate and read the policy details carefully. Absa's travel insurance is backed by Bryte Insurance Company Limited.

Knowing what your ABSA credit card travel insurance covers can save you a lot of stress and unexpected costs. Travel smart and enjoy your journey!

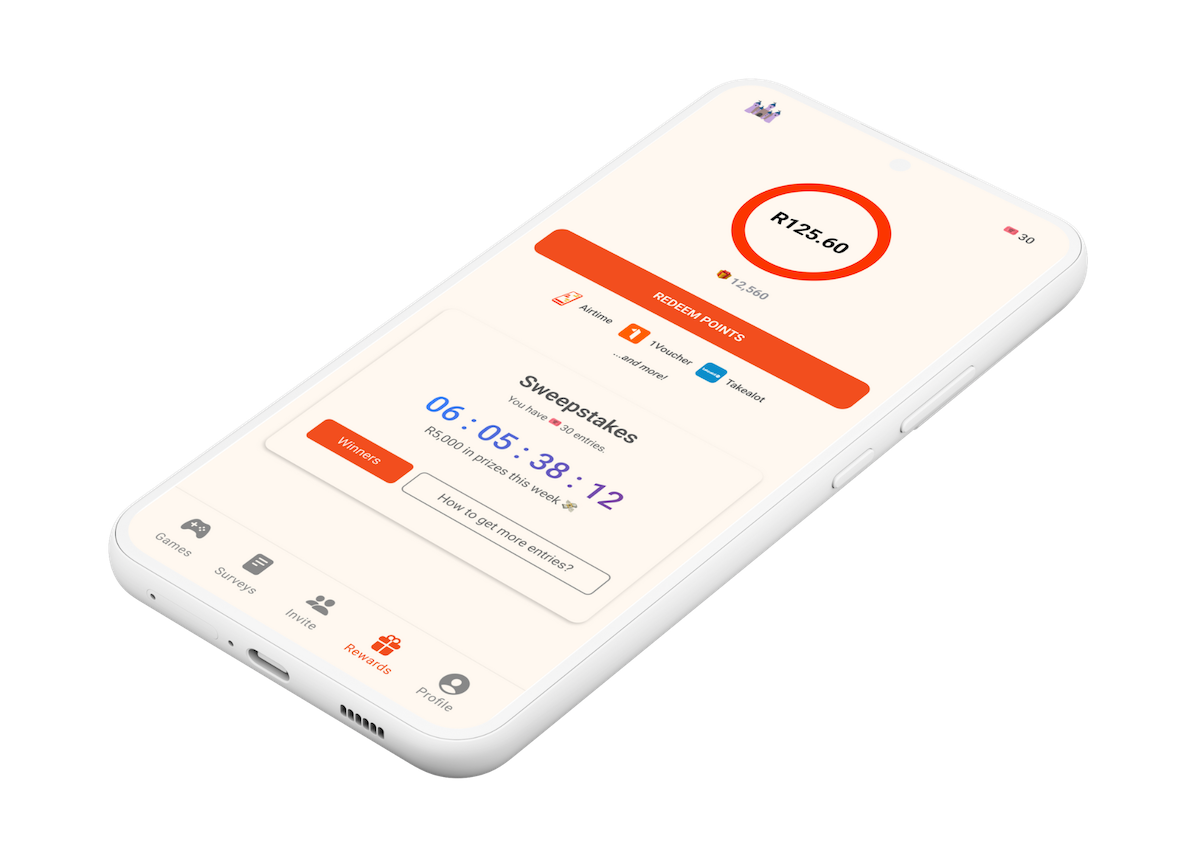

Ready for your next adventure? Make sure you're getting the most out of your everyday spending to save up for those dream trips. With the Points Castle App, you can turn your regular mobile use into exciting rewards, helping you reach your travel goals faster.