Which Credit Bureau Does ABSA Use

If you're wondering which credit bureau ABSA uses, you've come to the right place. Getting a loan or even just applying for a new phone contract often involves a credit check, and knowing who's looking at your financial history is a good first step to understanding your own credit health.

Simply put, ABSA, like many other banks in South Africa, doesn't rely on just one credit bureau. They work with a few key ones to get a full picture of your financial habits. The main credit bureaus ABSA uses are Experian and TransUnion. They also tap into information from others to make sure they have all the details.

Why Do Banks Use Credit Bureaus Anyway?

Credit bureaus are like big record keepers for your financial life. They collect information about how you handle money, like if you pay your bills on time, how much debt you have, and how old your accounts are. Banks like ABSA use this information to create a credit score for you. This score helps them decide if lending you money is a good idea and what interest rate to offer.

For example, I remember a few years back when I applied for my first car loan. I thought all banks used the same system, but the loan officer at ABSA actually mentioned they check with a couple of different bureaus. She explained that each one might have slightly different info, so they get a more complete picture by checking more than one. It made sense - they want to be sure you can really pay back what you borrow.

The Major Players in South Africa

While there are many credit bureaus in South Africa, a few stand out as the main ones that most financial institutions, including ABSA, work with:

- Experian: This is a big one, operating in many countries. ABSA uses Experian to assess clients' credit status.

- TransUnion: Another major bureau that has been around for over a century. ABSA's "Credit Coach" tool actually shows you your TransUnion score.

- Compuscan: The first African credit bureau, they focus on providing full credit management solutions.

- XDS (Xpert Decision Systems): This is a 100% black-owned credit bureau in South Africa, known for its innovative solutions.

These bureaus gather your credit history from various lenders and put it into a credit report. This report is what lenders check when you apply for credit.

Keeping an Eye on Your Credit Score

It’s a really good idea to check your credit report regularly. You can get one free report each year from each major credit bureau. Why is this important? Well, sometimes mistakes can happen, or you might find old information that needs updating. Knowing what’s on your report helps you understand your financial health and work on improving it if needed.

I recently helped my cousin check his credit score when he was struggling to get a loan. Turns out, there was an old phone contract listed as unpaid that he'd actually settled years ago! We got it sorted out, and his score jumped up. It just goes to show that keeping an eye on these reports is crucial.

Having a good credit score means you're more likely to get approved for loans, credit cards, and even better interest rates. It shows banks you're a responsible borrower.

Monitoring your credit score and making sure your financial information is accurate is a smart move for anyone. It's a key part of your financial journey and can open doors to many opportunities.

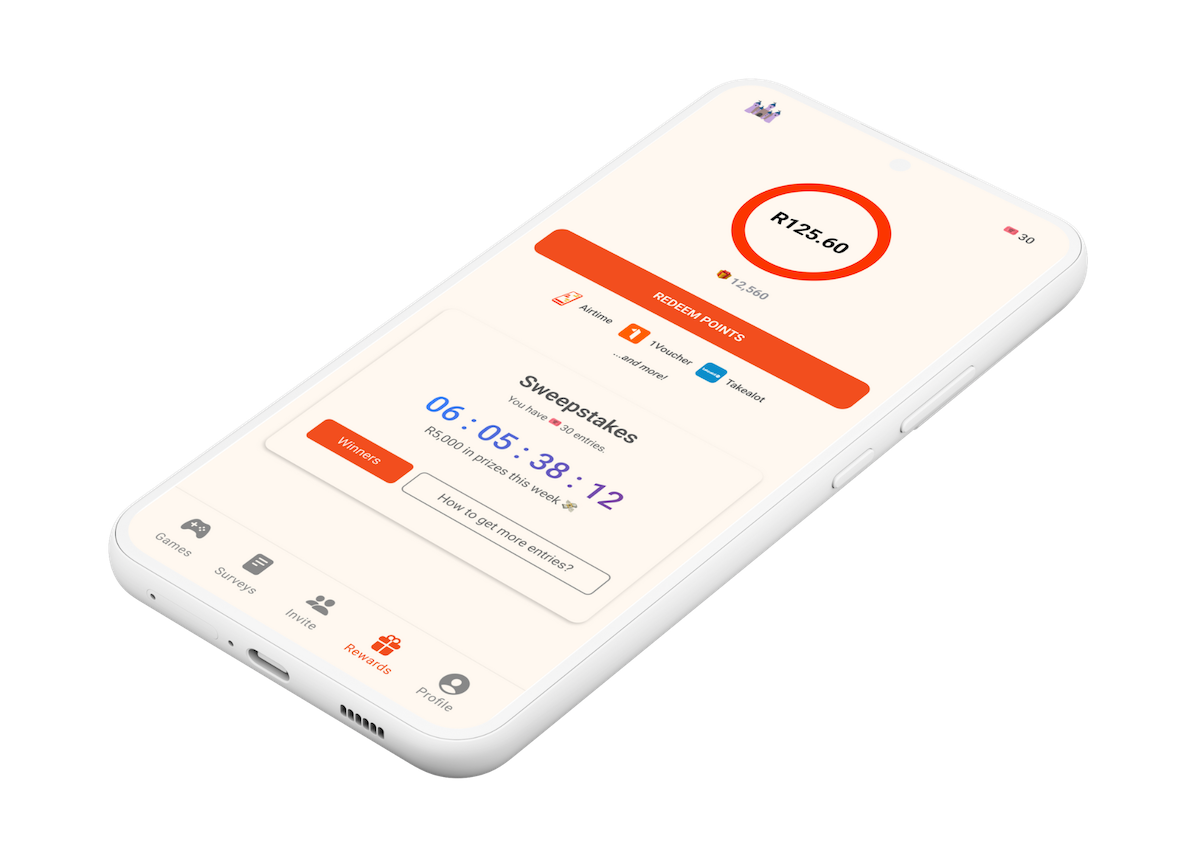

Want to keep earning rewards for your everyday actions? Check out the Points Castle App, where you can earn points and get great vouchers to help manage your finances.