How Does ABSA Depositor Plus Work?

The Absa Depositor Plus account is a savings account designed to help you grow your money while still giving you easy access to it. It offers tiered interest rates, meaning the more you save, the more interest you can earn. There are no monthly management fees, and you can deposit funds whenever you want or set up regular payments.

How Absa Depositor Plus Helps Your Savings Grow

The Absa Depositor Plus account is built around a few key features that make saving simple and rewarding. Here's a breakdown of how it works:

1. Tiered Interest Rates

One of the best things about Depositor Plus is that it rewards you for saving more. The interest rate you earn goes up as your account balance grows. For example, balances between R15,000 and R24,999.99 could earn a higher rate than smaller amounts. This encourages you to keep adding to your savings, knowing you'll get a better return. I remember when I first started saving, I thought all savings accounts were the same. Learning about tiered interest rates was a game-changer because it showed me how to make my money work harder just by reaching certain balance goals.

2. Digital Bonus Rate

If you like managing your money on your phone or computer, you're in luck. Absa offers an extra "Digital Bonus Rate" if you open and manage your Depositor Plus account using the Absa Banking App or Absa Online. This is a nice little perk for those who prefer digital banking, adding even more to your interest earnings.

3. Easy Access to Your Funds

Unlike some fixed-term investments where your money is locked away, the Depositor Plus account gives you immediate access to your funds whenever you need them. This flexibility is super helpful for unexpected costs or when you just want to grab some of your savings without waiting.

4. No Monthly Fees

Nobody likes paying fees that eat into their savings. The good news is that the Absa Depositor Plus account has no monthly management fees. This means more of your money stays in your account, working for you.

5. Flexible Deposits

You can add money to your Depositor Plus account whenever you want. You can also set up a regular payment of R250 or more each month, which is a great way to build up your savings steadily without even thinking about it. I personally find setting up automatic transfers really useful. It's like my money just disappears into savings without me having to remember to do it manually. It makes saving feel effortless.

6. Unlimited Transfers

You get unlimited inter-account transfers, allowing you to easily move money between your Depositor Plus account and other Absa accounts. This makes managing your finances within Absa very smooth.

To apply for a Depositor Plus account, South African citizens generally need their ID and proof of residence (not older than three months). Non-South African citizens will need a valid passport, proof of residence, and a work/resident permit.

The Absa Depositor Plus account is a solid choice if you're looking for a flexible savings option that rewards you with better interest rates as your balance grows, all while offering easy access to your money and no monthly fees. It's a great way to put your money aside for future goals or a rainy day.

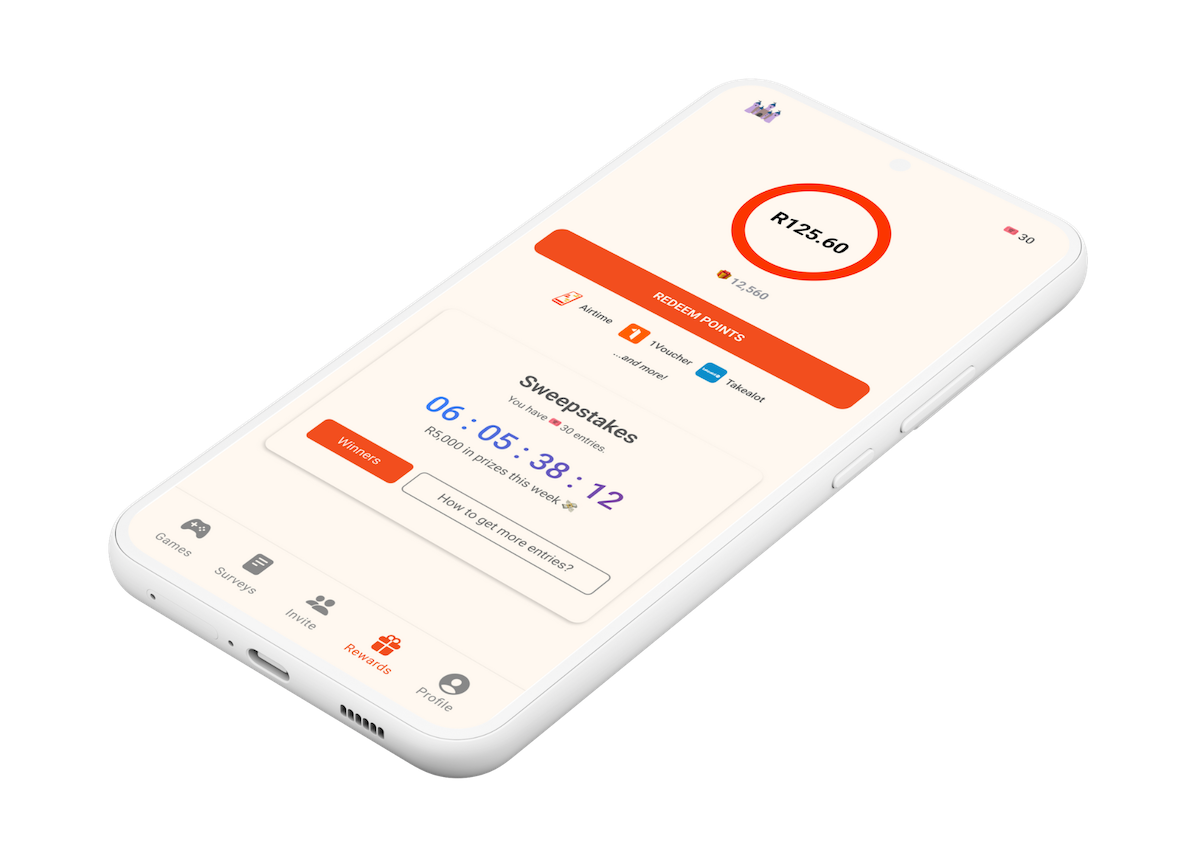

Looking for ways to boost your savings even further? Consider checking out the Points Castle App, where you can earn rewards that could help you reach your financial goals faster.