How Does the Nedbank Overdraft Work?

An overdraft from Nedbank is a financial tool linked to your current account, giving you access to extra money when your account balance hits zero. It's like a safety net for those unexpected expenses or when you need to cover costs before your next payday. You only pay interest on the amount you actually use, not on the full approved limit.

What is a Nedbank Overdraft?

A Nedbank overdraft is a flexible credit option without a fixed repayment term, unlike a personal loan which has set monthly payments. It acts as a revolving credit facility, meaning as you repay the amount you've used, that credit becomes available again. Limits typically range from R500 to R250,000. This facility is primarily designed to help manage temporary cash flow challenges or cover unforeseen expenses.

One time, I had a sudden car repair bill pop up right before payday. My budget was tight, and I really didn't want to dip into my savings. Luckily, I had a Nedbank overdraft facility on my account. The car was fixed, and I just paid back the overdraft when my salary came in, avoiding any late payment fees on the repair. It was a lifesaver for that "eish" moment!

How Does It Work?

When you have a Nedbank overdraft, it's connected directly to your transactional account (current or savings). If your account balance goes to R0, you can start using the available overdraft amount. When your salary or any other funds are deposited into your account, they will automatically go towards paying back the overdraft you used.

You'll only be charged interest on the specific amount you use, not on the total overdraft limit that's been approved. This interest is calculated daily on the outstanding balance and charged to your account monthly. It's important to remember that the interest rate can change with the prime interest rate.

Who Can Apply and What You Need

To qualify for a Nedbank overdraft, you generally need to be 18 years or older and have a qualifying Nedbank transactional account where your salary is paid. If you don't have a Nedbank account, they might open one for you, but there are usually income requirements. For example, you might need to earn at least R6,000 if you already have an active Nedbank current account, or R7,000 if you're a new client.

When you apply, you'll need:

- Your valid South African ID card or document.

- Your most recent payslip or a letter from your employer.

- Three months' bank statements if your salary isn't paid into a Nedbank account or if you're not yet a Nedbank client.

I remember my cousin was trying to get an overdraft to cover some unexpected medical bills. He'd just started a new job and his salary was being paid into a different bank. He found that getting all the right documents, especially the bank statements from his old account and proof of his new income, was key to making the application smooth. It took a bit of effort, but having that extra financial buffer made a real difference for him.

You can apply for a Nedbank overdraft through their Money app, Online Banking, or by visiting a branch. Once approved, you can also increase or decrease your overdraft limit through these digital channels.

Having a Nedbank overdraft can be a smart way to manage your finances, especially for those unpredictable moments. Just remember to use it wisely and understand the fees and interest involved.

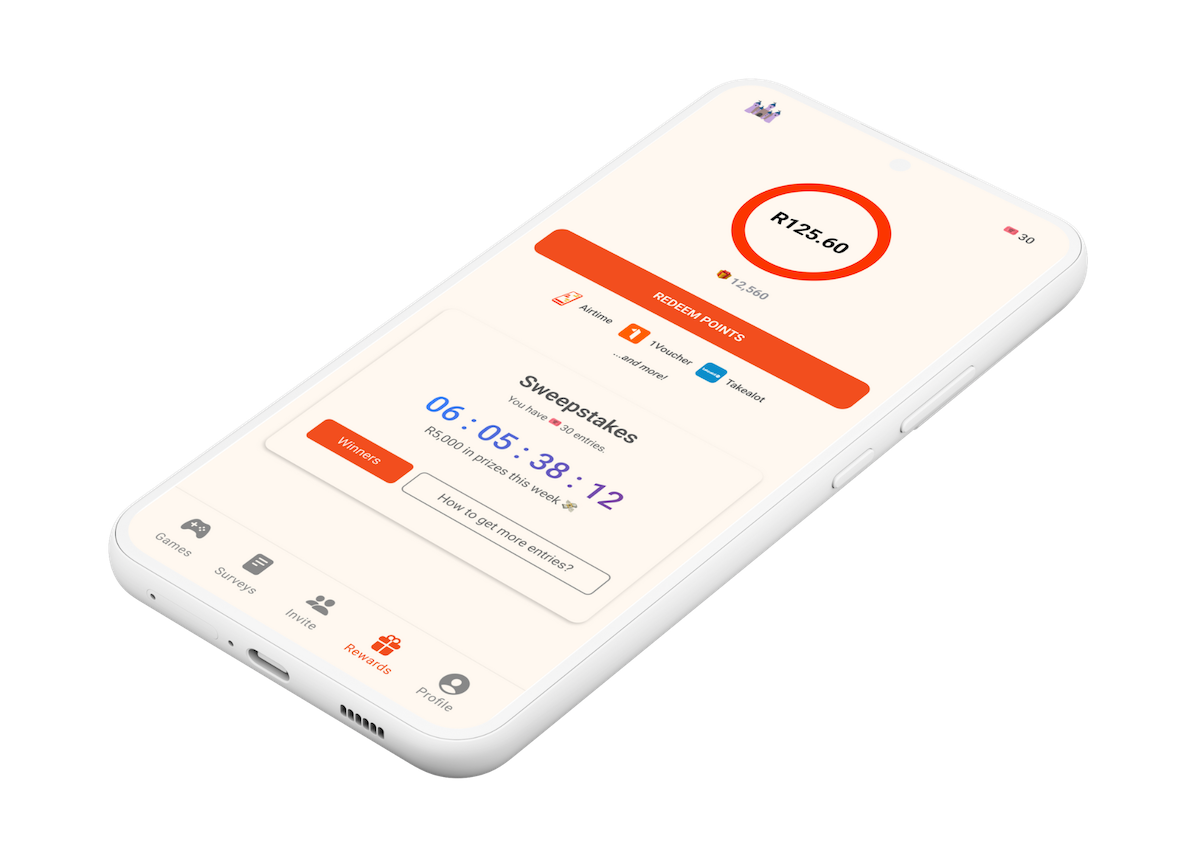

When you're looking for smart ways to manage your money and even earn some extra benefits, remember that the Points Castle App can help you discover various opportunities.