How to Check My Credit Score on the Nedbank App

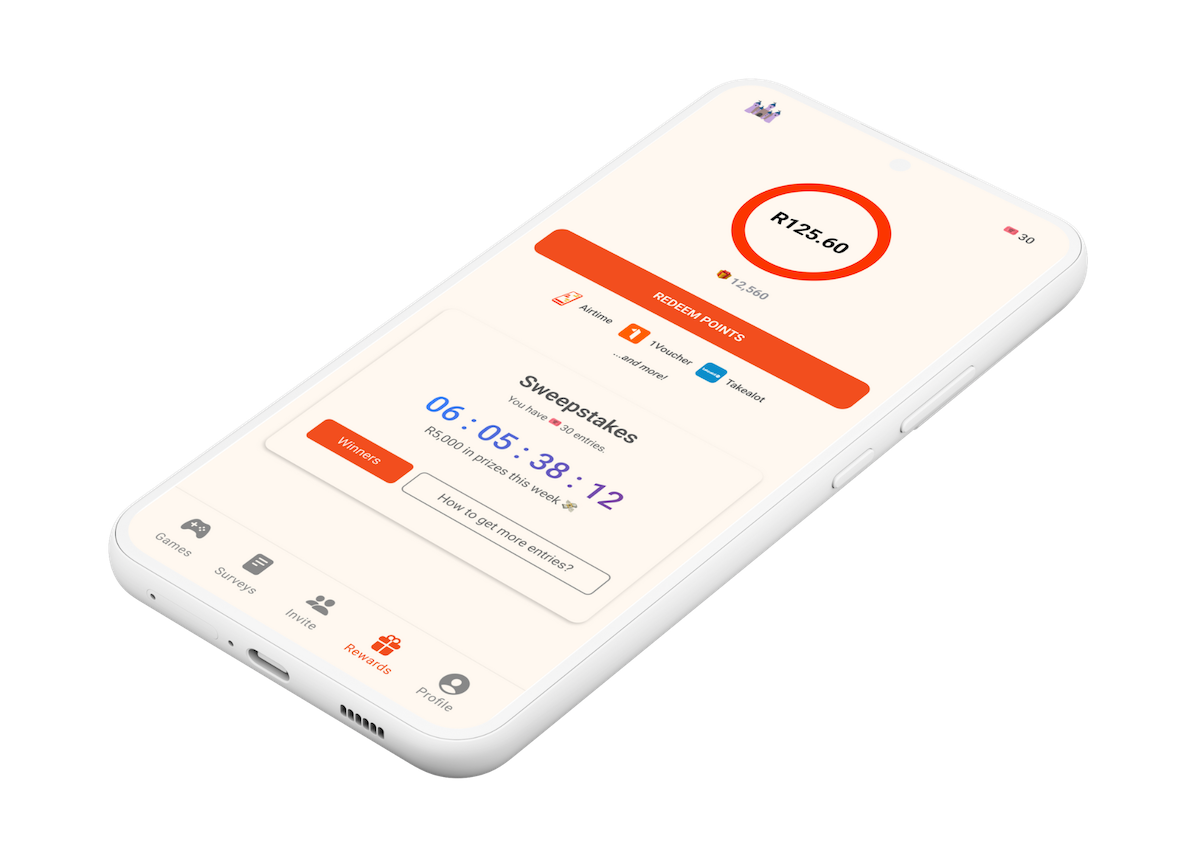

Want to know your credit score and how it affects your money choices? If you're a Nedbank client, you're in luck! You can easily check your credit score for free, as often as you like, right there on the Nedbank Money app. This makes keeping an eye on your financial health super simple.

Your credit score is like a report card for how you handle borrowed money. It’s a number that banks and lenders look at when you ask for things like a loan, a new credit card, or even a cell phone contract. A good score shows them you're responsible and likely to pay back what you borrow. A lower score might mean they see you as a bigger risk, which can make it harder to get credit or mean you get offered higher interest rates. Keeping track of it helps you stay in control of your financial future.

Why Your Credit Score Matters

Having a healthy credit score is a big deal. It opens doors when you need them most - whether it’s for an unexpected expense, buying a car, or even your dream home. Nedbank, working with Experian, helps you keep tabs on this important number. Your score typically falls between 520 and 730. The higher your score, the better you’re doing. If your score is on the lower side, don't worry, the app even gives you tips on how to make it better.

A few months ago, I was thinking about getting a new car, and I knew my credit score would play a big part in getting a good deal on car finance. I’d heard about checking it on the Nedbank app, so I decided to give it a try. It was super easy to find, and seeing my score right there gave me a good idea of where I stood before even talking to anyone at the dealership. It really helped me feel prepared and confident.

Here’s how you can check your credit score on the Nedbank app:

1. Download and Update the App: First, make sure you have the latest version of the Nedbank Money app on your phone.

2. Log In: Open the app and sign in using your usual details.

3. Find Financial Wellness: Once you're in, swipe right in the main menu. You'll then see the "Financial Wellness" dashboard.

4. Access Your Score: Look for "Your credit score dashboard" or "My Smart Money" and tap on it.

5. View Your Score: Here, you’ll see your credit score, along with information on what affects it and advice on how to improve it.

It's really that simple. Nedbank offers this service for free, and you can check it as often as you like without it hurting your score. This is a huge advantage, as typically you're only entitled to one free credit report a year from a credit bureau.

I remember once I was trying to get a new phone contract, and I was worried my credit score might not be good enough because of an old account I’d forgotten about. Checking it on the Nedbank app showed me exactly what was affecting it. The app even gave me some pointers on what to do. I followed the advice, paid off the small outstanding amount, and a couple of months later, when I checked again, my score had improved enough for me to get that new phone. It felt great to see real progress!

Keeping your credit profile in good shape is a continuous effort. Paying your accounts on time, not applying for too much credit at once, and trying not to use more than half of your available credit are all smart moves. The Nedbank app helps you stay on track with all this, giving you monthly updates and useful tips.

While the Nedbank app offers a fantastic way for its clients to stay informed, you can also get a free credit report once a year directly from South African credit bureaus. Services like ClearScore also offer free credit reports and scores. However, for Nedbank users, the in-app feature is definitely the most convenient way to keep your financial health in check.

Taking control of your credit score is a smart step towards financial freedom. By regularly checking your credit score on the Nedbank app, you empower yourself with the knowledge and tools to improve your financial well-being. And speaking of making smart money moves, did you know that with Points Castle, you can earn rewards that help you save on everyday expenses? It's another great way to boost your financial health!