How Long Does an ABSA International Transfer Take?

International money transfers can sometimes feel a bit like sending a message in a bottle across the ocean - you're never quite sure when it will arrive. If you're looking to send money overseas with Absa, you're probably wondering how long it will take for your funds to reach their destination.

The short answer is that an Absa international transfer usually takes between 1 to 5 business days for SWIFT payments. However, some transfers might even take up to two days for the money to reflect, and in rare cases, up to three weeks if the destination country is considered "slow-to-pay". If you're using Absa's Visa Direct service, funds can be available in 30 minutes or less, but this is specifically for receiving international transfers onto an Absa Visa debit or credit card.

What Affects the Transfer Time?

Several things can change how long your money takes to get where it's going:

- Type of Transfer: Most international transfers from Absa use the SWIFT network. This is a reliable way to send money, but it involves different banks talking to each other, which can add time.

- Destination Country and Time Zones: Sending money to a country in a different time zone, especially eastward, can mean delays. If you initiate a payment to China when it's already closing time there, it won't be processed until their next business day.

- Correspondent Banks: Sometimes, Absa might need to send your money through other banks (called correspondent banks) to reach the final destination. Each extra bank involved can add another day or two to the process.

- Currency Conversion: If you're sending money in one currency and it needs to be converted to another, this can sometimes take a bit longer.

- Regulatory Requirements: International banking in South Africa is heavily regulated. You'll need to meet exchange control requirements and provide all necessary documentation. Delays can happen if your paperwork isn't quite right. Absa will need your beneficiary's full bank details, account number, name, and residential address.

- Cut-off Times: Banks have specific cut-off times for international payments. If you send your instruction after this time, it will only be processed on the next business day.

I remember one time I was sending money to my cousin in the UK for his birthday. I thought I had done it well in advance, but I forgot about the time difference and sent it quite late in the afternoon, South African time. It ended up arriving a day later than I hoped because their banks were already closed. He still got his present money, but it taught me to always double-check those time zones!

Tips for a Faster Transfer

To help your Absa international transfer go as smoothly and quickly as possible:

- Send Early: If it's urgent, try to initiate the transfer early in the day. This gives it the best chance of being processed the same day, especially for destinations in similar or westward time zones.

- Double-Check Details: Make sure all the beneficiary's details, including their bank name, account number, SWIFT code, and address, are 100% correct. Even a small error can cause big delays or even a failed transfer.

- Have Documents Ready: Ensure you have all the required documents and meet all regulatory requirements for the payment type. Absa's team of international banking specialists can help with this.

- Use Online Banking/App: Using Absa Online Banking or the Banking App can sometimes speed things up compared to going into a branch, and often comes with lower electronic fees.

- Consider Visa Direct (for receiving): If you are receiving money, and the sender can use Visa Direct, funds could be available in your Absa Visa card account in 30 minutes or less. This is super fast!

- Track Your Payment: Absa is a member of SWIFT GPI (Global Payments Innovation), which means you can often track your cross-border payment to see its status.

In summary, while there isn't one fixed answer, expecting your Absa international transfer to arrive within 1 to 5 business days is a good rule of thumb. Planning ahead and ensuring all your details are correct can make a big difference in how quickly your money reaches its destination.

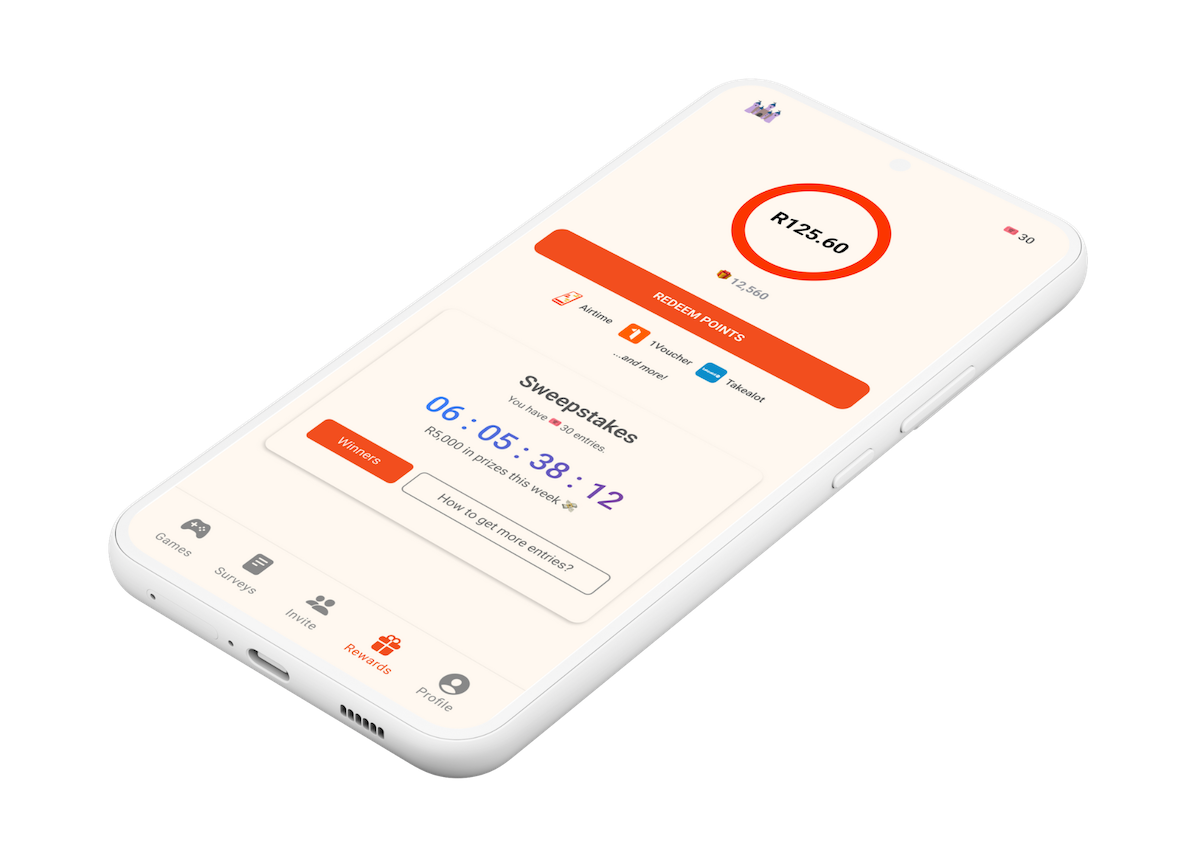

Did you know that managing your finances smartly can also help you get more value out of your money? With the Points Castle app, you can discover ways to earn rewards and save, giving you more to potentially send or spend.