How Long Does Standard Bank Instant Money Last?

If you've received Standard Bank Instant Money or sent it to someone, you might be wondering how long it actually lasts. The good news is that Standard Bank Instant Money vouchers are valid for a generous period of 3 years from the date they are first issued. This means you have plenty of time to collect or use the funds.

Standard Bank Instant Money is a handy service that lets you send cash to anyone with a South African cellphone number, even if they don't have a bank account. It’s super useful for sending money quickly for emergencies or simply when you need to get cash to someone who might not be near a bank branch. The sender gets a voucher number and a PIN, which are then shared with the person receiving the money.

How Long Do Standard Bank Instant Money Vouchers Last?

Your Standard Bank Instant Money voucher, along with its associated PIN, is valid for three full years from the date it was created. This long validity period gives you a good window to make sure the money is collected. It's unlike some other temporary cash services that expire much faster.

I remember my cousin once sent me Instant Money for my birthday, but I was out of town for a few weeks and completely forgot about it when I got back. I only remembered when I was cleaning out my SMSes months later! Luckily, because of the long validity, the money was still there, safe and sound, for me to collect when I finally got around to it. It definitely saved me some embarrassment!

This extended timeframe is put in place to give both senders and receivers peace of mind. Life happens, and sometimes you can't get to an ATM or a participating store right away. Whether it's a forgotten SMS or simply being too busy, the three-year window prevents you from losing out on the funds.

What to Do If You Don't Use It Within the Timeframe

While three years is a long time, it's always best to collect your Instant Money as soon as you can. If, for some reason, the three years pass and the money hasn't been collected, you should contact Standard Bank directly. They will be able to guide you on any options available to either the sender or the receiver, depending on their terms and conditions at that time.

Quick Tips for Using Instant Money

- Collection Points: You can collect Instant Money at any Standard Bank ATM or a participating retail store like SPAR, Pick n Pay, Shoprite, Checkers, and others.

- Daily & Monthly Limits: There are limits on how much you can send and receive. You can typically send and withdraw up to R5,000 per day and up to R25,000 per month. This is important to remember if you're dealing with larger amounts. I once had to tell a friend sending me money to split a larger amount over two days because they hit the daily limit. It's a small detail but can save you a trip!

- Keep PIN Safe: Always keep your voucher number and PIN secret. Only share the PIN with the person meant to receive the money.

- Resending or Resetting: If the recipient loses the SMS with the voucher or PIN, the sender can usually resend it or reset the PIN through the Standard Bank app or cellphone banking.

Knowing how long your Standard Bank Instant Money lasts gives you confidence in using this convenient service. Just remember that three years is a long time, but it’s always best to collect your funds sooner rather than later.

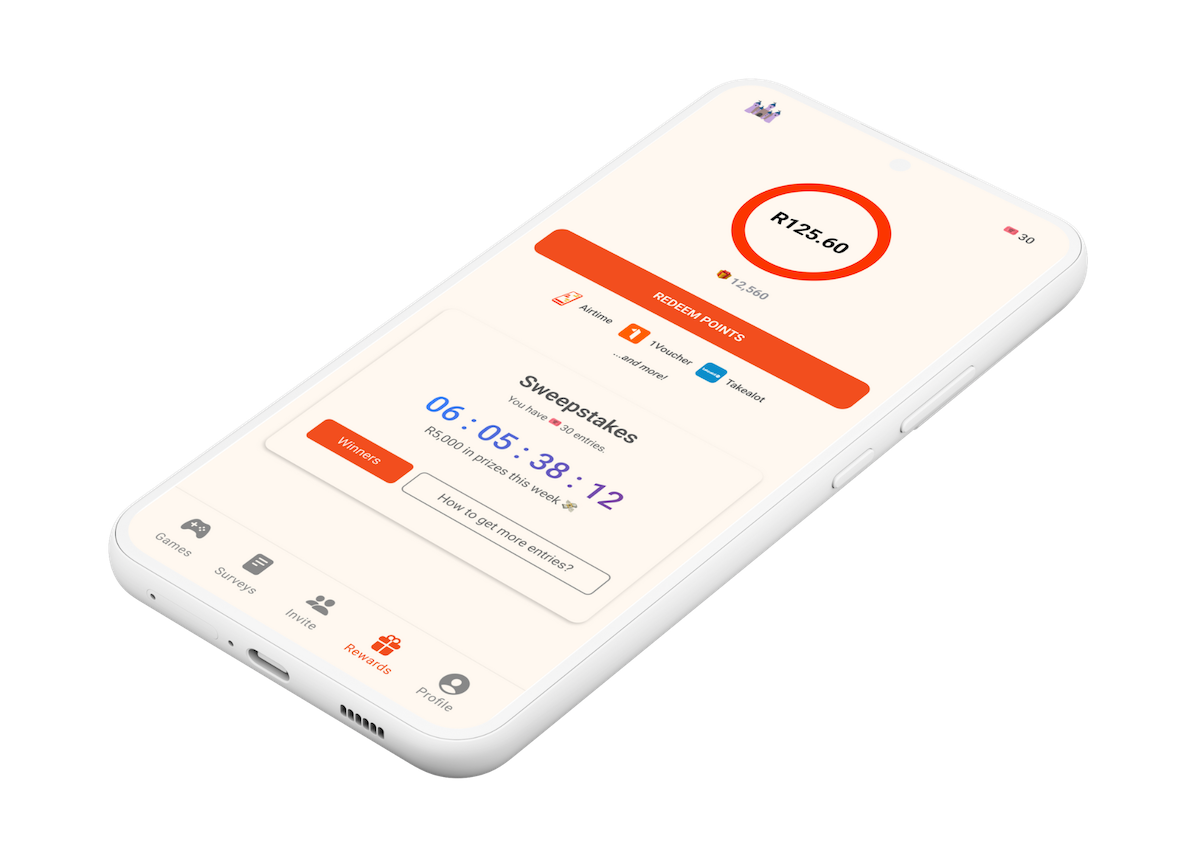

And if you're looking for clever ways to earn extra cash or vouchers that can make sending and receiving money even easier, remember to check out the Points Castle App.