How to Apply for a Second Bond at Standard Bank

Applying for a second bond at Standard Bank is definitely possible, but it's not simply a repeat of your first bond application. Standard Bank, like other lenders, will assess your financial situation again, looking at things like the equity in your current property, your income, and your overall debt. You essentially apply for it in the same way you would a new home loan.

A second bond means you're taking out another home loan on a property, often using your current bond as collateral. People usually do this for a few key reasons: to get funds for home improvements, consolidate debt, or even invest in another property. Whatever your reason, understanding the process and what Standard Bank looks for is key.

What is a Second Bond and Why Apply for One?

Think of a second bond as another bite at the cherry, financially speaking, but tied to your property. It's essentially a new home loan registered against a property that already has a bond. Standard Bank offers a few ways to access additional funds on your existing home loan: a "re-advance" or an "additional bond" (which is sometimes called a second bond).

- Re-advance: This lets you borrow back a portion or the full amount of your original home loan that you've already paid off. The good thing about a re-advance is you don't need to register another bond, making the process quicker.

- Additional Bond (Second Bond): This involves registering a completely new bond on your property to access the funds you need. This is generally for larger amounts than a re-advance.

Why would you go this route?

- Home Improvements: Many people use a second bond to fund big renovations, like adding a new room or updating a kitchen.

- Debt Consolidation: If you have several high-interest debts, a second bond can offer a lower interest rate, helping you pay them off more easily.

- Property Investment: You might use the funds to buy another property, perhaps as a rental income source or a holiday home.

I remember my uncle wanted to put in a swimming pool and a new entertainment area. He'd paid off a good chunk of his first bond, and instead of taking out an expensive personal loan, he looked into a re-advance with Standard Bank. It felt like a smart move because the interest rate was much better, and he could spread the payments over a longer time, which really helped his budget.

How to Apply for a Second Bond at Standard Bank

Applying for a second bond at Standard Bank is similar to applying for your first home loan, as they will assess your financial health all over again.

Here's a general idea of the steps:

1. Check Your Eligibility:

- Equity in Your Home: Lenders like Standard Bank will want to see significant equity in your first property. This is the difference between what your home is worth and what you still owe on your bond.

- Credit Score: A good credit record is super important. It shows the bank you're a responsible borrower and can lead to better interest rates.

- Income Stability and Debt-to-Income Ratio: Standard Bank will look at your current income and how much debt you already have. They want to make sure you can afford the new monthly repayments on top of your existing ones. A stable job history helps a lot here.

2. Gather Your Documents:

You'll need documents similar to your first bond application, such as:

- Proof of identity (ID document)

- Proof of income (payslips, bank statements)

- Proof of address

- Statements for your existing bond and any other debts

- If you're using the funds for home improvements, you might need approved building plans and detailed quotations.

3. Submit Your Application:

You can apply for an additional bond or re-advance by:

- Calling Standard Bank directly on their home loan number.

- Visiting your nearest Standard Bank branch.

- Applying online through their website.

4. Assessment and Approval:

Standard Bank will review your application, assess your property's value, and check your affordability. If approved, they will give you an offer.

It's a good idea to chat with a bond originator too. They can help you compare options from different banks, including Standard Bank, and guide you through the whole process.

A few years ago, a friend of mine was drowning in credit card debt. The interest rates were killing him. He owned his flat outright, so I suggested he look into a second bond to consolidate everything. It was a bit scary for him at first, taking on another bond, but once he saw how much lower his monthly payments would be and how much quicker he could pay off his debt with the better interest rate, he went for it. It completely turned his financial situation around.

Important Things to Consider

- Costs: Applying for an additional bond comes with bond registration costs. These can include attorney fees, deeds office fees, and potentially a bank initiation fee.

- Interest Rates: While often lower than personal loans, the interest rate on your second bond can still impact your monthly repayments significantly.

- Long-Term Commitment: Remember, a second bond means more debt and a longer commitment to repayments. Make sure you're comfortable with the added financial responsibility.

- Affordability: Always be realistic about what you can afford each month. Don't overextend yourself.

Applying for a second bond at Standard Bank can be a great way to unlock the value in your property for various financial goals. Just make sure you do your homework, understand all the costs involved, and ensure it's the right move for your financial future.

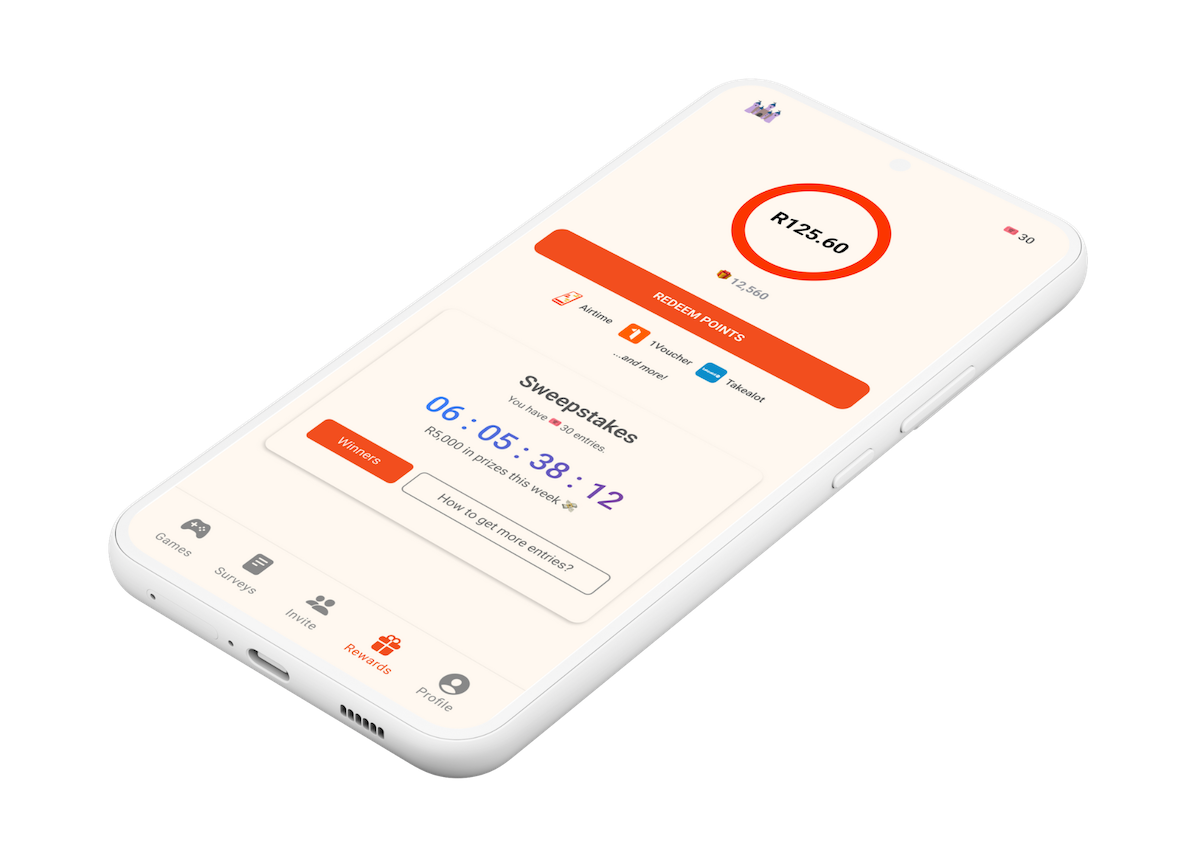

And hey, while you're managing your finances and making smart decisions, remember that every little bit helps. You can even earn free airtime and other rewards by using the Points Castle App, giving you a little extra wiggle room in your budget!