How to Activate Payshap on the Standard Bank App

Activating PayShap on your Standard Bank app is a straightforward process that lets you send and receive money instantly using just your cellphone number. You'll need to register a unique "ShapID" within the app, linking it to your preferred bank account, and then you're all set to make and receive quick payments.

Here’s how you can get started:

Registering Your PayShap ID on the Standard Bank App

Setting up your PayShap ID, also known as a ShapID, on the Standard Bank app only takes a few steps. Once done, you can enjoy fast and easy payments.

1. Open and Log In: First, open your Standard Bank app on your phone and log in with your PIN or biometrics.

2. Go to 'Manage': From your home screen, look for and select the "Manage" option.

3. Find PayShap: Within the "Manage" menu, you'll see a "PayShap" option. Tap on it.

4. Manage ShapIDs: On the PayShap screen, select "Manage ShapIDs".

5. Add Your ShapID: To begin, choose "ADD SHAPID" to start the registration process for receiving PayShap payments.

6. Select Your Cellphone Number: You'll need to register your cellphone number as your ShapID. If you have a few numbers linked to your bank profile, pick the one you want to use.

7. Set as Primary (Optional): You can toggle on the "Primary ShapID" option. This makes your Standard Bank account the main one for that cellphone number. If it's primary, people only need your cellphone number to pay you. If not, they'll need your number and the bank name.

8. Choose Your Account: If you have more than one bank account, select which one you want to link to your ShapID for receiving payments.

9. Review Details: Once you've entered everything, select "REVIEW" at the top to check your details, like the cellphone number and linked account.

10. Accept Terms and Conditions: Read through the PayShap terms and conditions. Then, tick the box to accept them.

11. Confirm Registration: Select "CONFIRM" to send in your ShapID details.

12. Enter OTP: A 5-digit One-Time Pin (OTP) will be sent to your chosen cellphone number. Enter this PIN to confirm your PayShap registration.

13. Done! Once the OTP is entered, you're all set. You've successfully registered your PayShap ID and can now receive payments by simply sharing your cellphone number.

I remember the first time I set up my PayShap ID. I was a bit unsure, thinking it would be complicated. But it was surprisingly quick. My friend needed to send me money for our lunch, and instead of asking for my account number, I just gave him my phone number. Within seconds, I got the notification - money in my account! It really is super convenient.

What is PayShap and Why Should You Use It?

PayShap is a modern digital payment service designed to make sending and receiving money between different banks in South Africa quick and easy. It’s like a faster EFT, but much simpler. Instead of long bank account numbers, you use a ShapID - most commonly your cellphone number - to identify your account.

This means:

- Instant Payments: Money moves in real-time, so the person you're paying gets it almost instantly, 24/7.

- Simplicity: No more fumbling for account numbers and branch codes. Just a cellphone number or a custom ShapID.

- Secure: Payments are made through your trusted banking app, keeping your transactions safe.

One time, I was trying to pay a small business owner for a handmade gift. They gave me their long bank account details, and I just kept messing up one of the numbers. After three tries, I asked if they had a ShapID. They gave me their cellphone number, and the payment went through immediately. It saved both of us a lot of hassle. It's really changed how I think about quick payments.

It's also important to note that while setting up a ShapID is free, there might be small fees for making PayShap payments, which are usually less than traditional instant payment fees. You can also make PayShap requests, allowing others to pay you.

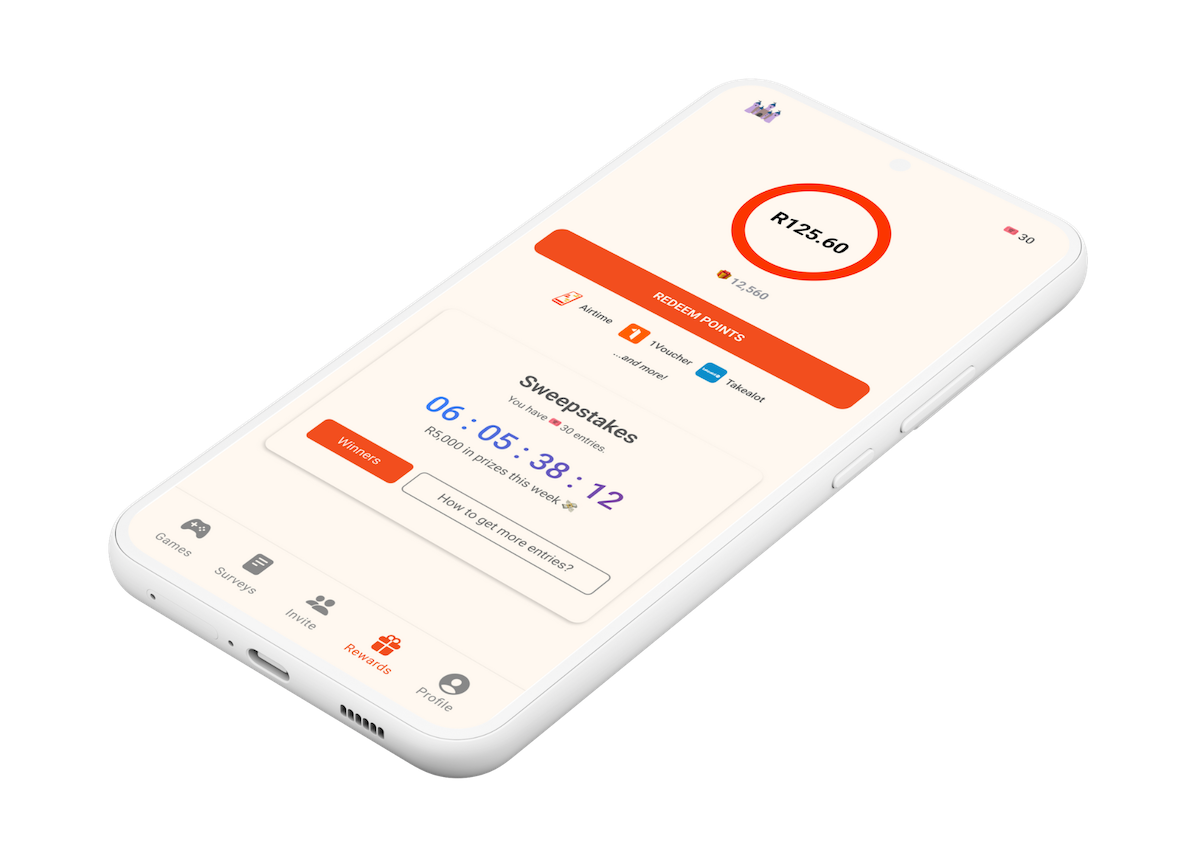

Now that you know how to activate PayShap on your Standard Bank app, you can enjoy seamless transactions. And if you're looking for other ways to make your money go further or earn rewards, remember to check out the Points Castle App.