How to Apply for a Loan at ABSA Online

Applying for a loan at ABSA online is a simple process you can complete from your computer or phone. You'll typically need to be an existing ABSA customer with online banking access and have your personal and financial details ready.

Getting a loan can feel like a big step, whether it's for a new car, home improvements, or just to help manage your money better. Luckily, ABSA has made it pretty easy to apply for certain loans right from your home, thanks to their online banking platform. No more long queues!

What Kinds of Loans Can You Get Online?

ABSA offers different types of loans that you can apply for online. The most common ones are:

- Personal Loans: These are flexible loans you can use for almost anything, from consolidating debt to funding a holiday.

- Home Loans: While the full application might be more involved, you can often start the application process for a home loan online, including pre-approvals.

- Vehicle Finance: If you're looking to buy a car, you can usually apply for vehicle finance through their digital channels.

Before you start, make sure you know which type of loan fits your needs best.

Getting Ready: What You'll Need

To make your online loan application smooth, have these things ready:

- Your ID number: This is a must for any official banking business.

- Proof of income: This could be your latest payslips or bank statements showing your salary. ABSA will need to see that you can pay back the loan.

- Proof of address: A utility bill or bank statement with your address on it, less than three months old, usually works.

- Your banking details: Specifically, your ABSA account number.

- Employment details: Information about your current job and how long you've been there.

I remember when my cousin applied for a personal loan last year. He thought he'd have to take a day off work to go to the bank, but I told him about the online option. He gathered all his documents the night before, and by lunch the next day, his application was submitted. It saved him so much hassle!

Steps to Apply for an ABSA Loan Online

Here's how to apply for your loan:

1. Log in to ABSA Online Banking: Go to the official ABSA website and log in using your existing online banking username and password. If you don't have online banking set up yet, you'll need to register first.

2. Navigate to the Loans Section: Once logged in, look for a section like "Apply for a Loan," "Loans," or "Credit." It's usually easy to find in the main menu or a quick links section.

3. Choose Your Loan Type: Select the specific type of loan you want to apply for (e.g., Personal Loan, Vehicle Finance).

4. Fill in the Application Form: You'll be asked to provide all the information you gathered earlier, like your personal details, employment information, and financial situation. Be honest and accurate.

5. Review and Submit: Double-check all the information you've entered. Mistakes can delay your application. Once you're sure everything is correct, click "Submit."

6. Upload Documents (if needed): Sometimes, even after filling out the online form, you might need to upload scanned copies of your documents. Follow the prompts carefully.

What Happens After You Apply?

After you submit your application, ABSA will review it. This involves checking your credit score, verifying your income, and assessing your ability to repay the loan. You might receive an SMS or email confirming receipt of your application.

Sometimes, they might call you to ask for more information or clarify something on your application. I once applied for a small credit facility, and I was surprised how quickly I got a call back to confirm a few details. It made the whole process feel very personal and efficient.

If your application is approved, you'll get an offer with the loan amount, interest rate, and repayment terms. Make sure you read through this carefully before accepting. Once you accept, the money is usually paid directly into your ABSA account.

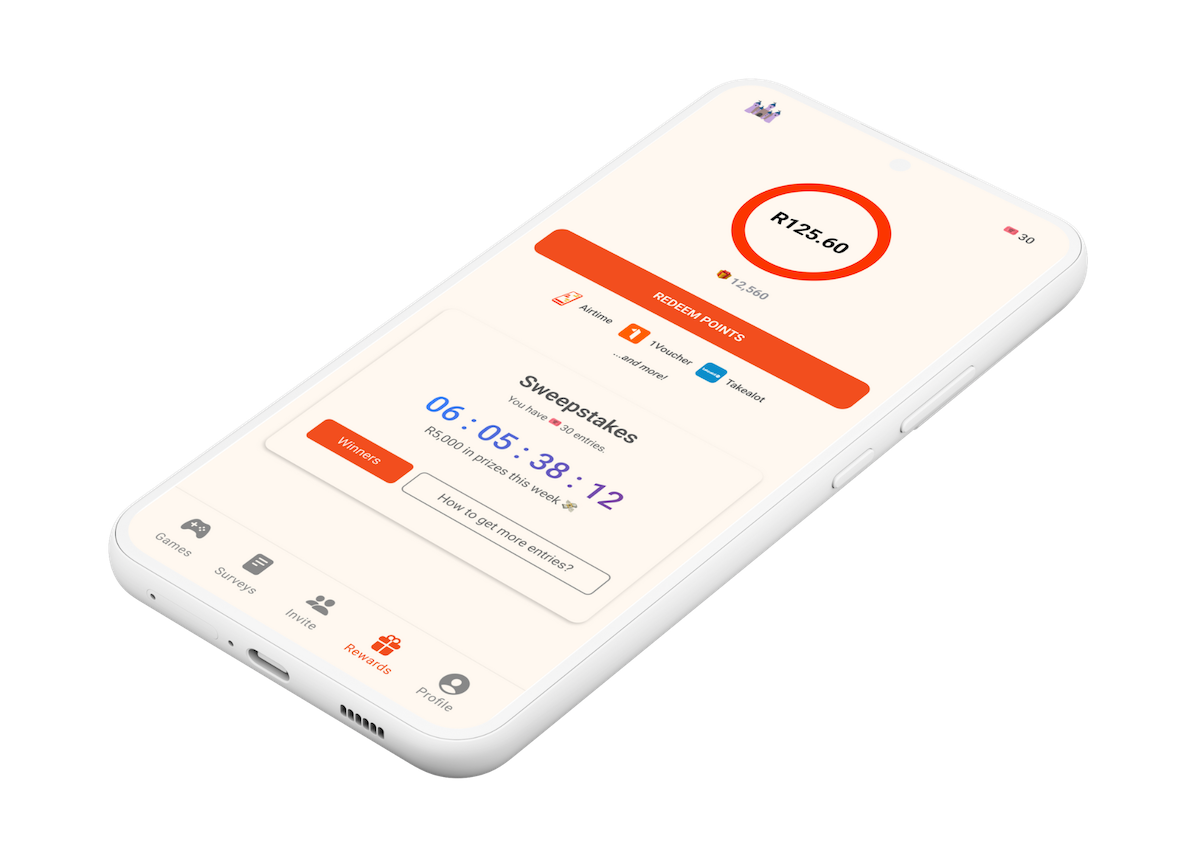

To make sure your loan application and all your other financial activities are as smooth as possible, it's always good to be mindful of your overall financial health. For instance, did you know you can even earn rewards and benefits for your everyday activities, like saving on airtime? Points Castle helps you do just that, giving you awesome rewards for things you already do. Check out the Points Castle App!