How to Apply for a Personal Loan at Nedbank

Applying for a personal loan at Nedbank is a pretty straightforward process, whether you prefer doing things online, through their app, or by visiting a branch. You'll generally need your ID, proof of income, and recent bank statements to get started.

Life throws unexpected things our way, and sometimes, a personal loan can be just what you need to manage a big expense or achieve a goal. Nedbank offers personal loans designed to help you, whether it’s for home renovations, consolidating debt, or covering an emergency. They aim to make the application process easy and quick, often giving you an answer fast.

What You Need Before Applying

Before you dive into the application, it’s a good idea to know what Nedbank will ask for. Having these documents ready will make the whole process much smoother.

Here's what you'll typically need:

- A valid South African ID (Smart ID card or barcoded identity document).

- Your latest payslip or other proof of income (like a letter of employment if you're a contract worker). If you're retired, proof of your pension payment will work.

- Your bank statements from the last three months. If you already bank with Nedbank, they might be able to get these for you directly.

- Proof of your residential address.

It's also really important to think about why you need the loan and how much you can truly afford to pay back each month. I remember last year, my washing machine broke down suddenly. It was an unexpected cost, and I knew I needed to replace it quickly. Before I even looked at loans, I sat down and figured out exactly how much I could comfortably afford in monthly repayments. This made choosing the right loan much easier.

Nedbank offers loans from R2,000 up to R400,000, with flexible repayment terms from 6 to 84 months, depending on your credit score. They'll give you a personalised interest rate, so it's worth checking what they can offer you.

How to Apply for Your Nedbank Personal Loan

Nedbank gives you a few ways to apply, so you can pick the one that works best for you.

1. Online or Through the Nedbank Money App

This is often the quickest way, especially if you're already a Nedbank client.

- Existing Clients: Simply log in to your Nedbank Money app or Online Banking. Go to the "Borrow" section, then choose "Personal Loan" and follow the prompts. If you're a client, you might even have pre-approved loan offers waiting for you, which speeds things up even more.

- New Clients: You'll need to register for a Nedbank ID first, then you can use those details to log in and apply online.

You'll need to provide your personal details, income, and expenses. Being accurate here is key for approval. You'll also upload certified copies of your documents (like your ID, payslip, and proof of address) – make sure they're in PDF format and not larger than 10MB per file. The online form takes only a few minutes to fill out, and if you qualify, you could get a loan offer based on your financial situation and credit score.

2. At a Nedbank Branch

If you prefer a face-to-face chat, visiting a Nedbank branch is a good option.

- Take all your required documents with you. This includes your ID, proof of address, latest payslip, and if you don't bank with Nedbank, your last three months' bank statements.

- A branch consultant will help you through the application process. Even in the branch, the application is done online, so they'll guide you as they capture your details. This is a great chance to ask any questions you might have about the loan.

3. Request a Call Back

Nedbank also offers a "call me back" service.

- You can fill out a short form online with your contact details.

- A call-centre agent will then phone you back to help you complete the application over the phone. You'll then need to email your documents to them.

My cousin told me about using the call-back option recently. He was a bit unsure about applying online because he had a few specific questions, and getting to a branch during working hours was tough. He said the consultant was super helpful and walked him through everything, explaining the credit life insurance and repayment terms clearly.

After You Apply: What Happens Next

Once you've submitted your application, Nedbank will process your information. They verify your details, check your credit record, and assess whether you qualify for the loan amount requested. Sometimes, they might even make a revised offer if their assessment suggests different terms are more suitable. This doesn't mean your loan is declined, just adjusted. Many times, you can get an answer on your application pretty quickly, sometimes in as little as 90 minutes if there are no delays.

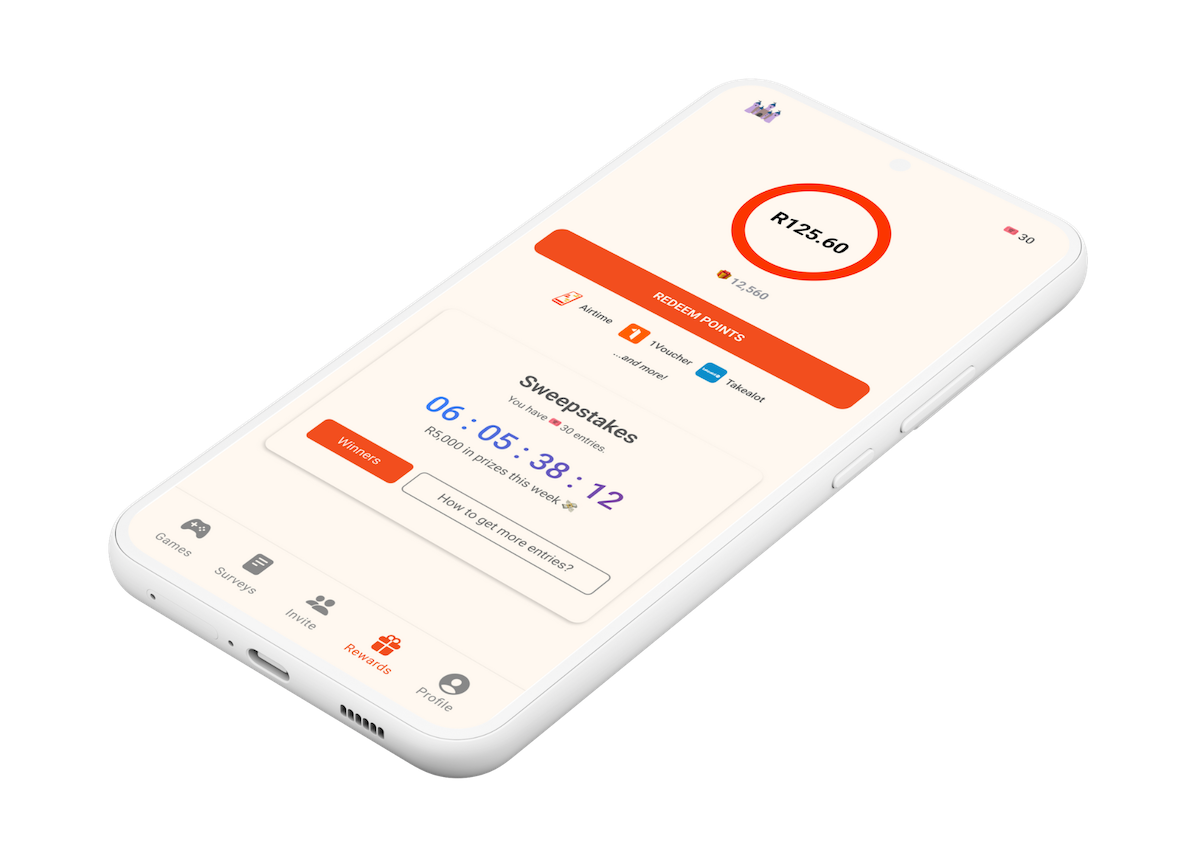

Getting a personal loan can be a big step towards reaching your financial goals or handling unexpected costs. Nedbank makes the application process accessible and understandable, giving you options to apply online, via their app, at a branch, or even over the phone. Make sure you have all your documents ready, understand your financial needs, and you'll be well on your way. If you're looking for other smart ways to manage your money and even earn rewards, remember to check out the Points Castle app.