How to Pay My Nedbank Credit Card From Absa

Paying your Nedbank credit card from your Absa account is straightforward using an Electronic Funds Transfer (EFT) through your Absa banking app or online banking. You'll need to add your Nedbank credit card as a beneficiary in your Absa banking platform, using Nedbank's details and your specific credit card number as a reference.

It's common to have accounts with different banks in South Africa, and managing your finances across them is essential. If you hold a Nedbank credit card but your primary transactional account is with Absa, you'll need to know the proper steps to ensure your credit card payments are made on time. Missing a payment can lead to extra fees and affect your credit score, so getting this right is important.

Step-by-Step Guide to Paying Your Nedbank Credit Card from Absa

Paying your Nedbank credit card from your Absa account is a simple process, mostly done online or via your banking app. Here’s how you can do it:

1. Log In to Your Absa Banking Platform: Start by logging into your Absa Banking App on your smartphone or the Absa Online Banking website on your computer. Make sure you're using a secure internet connection.

2. Navigate to Payments: Once logged in, look for the "Pay" or "Payments" section. On the Absa Banking App, you'll typically tap on "Pay".

3. Add a New Beneficiary: Since you're paying a Nedbank credit card, it's likely a new beneficiary. Select the option to "Pay new beneficiary" or "Pay Someone New".

4. Enter Nedbank's Details:

- Beneficiary Name: You can use "Nedbank" or "Nedbank Card Division".

- Bank Name: Nedbank

- Account Number: This is crucial. Use the account number linked to your Nedbank credit card. This is usually found on your credit card statement, or you can confirm it by calling Nedbank directly. Avoid using the 16-digit card number itself for the beneficiary account number, as this is for card transactions, not EFTs.

- Branch Code: Nedbank's universal branch code is often 198765, but it's best to confirm this if your statement provides a different one.

5. Set Your Reference: In the beneficiary reference field, *always* use your Nedbank credit card number (the 16-digit number on the front of your card). This ensures Nedbank correctly allocates the payment to your specific credit card account. For your own reference, you can add something like "Nedbank CC Payment" in your reference field.

6. Enter Payment Amount and Type: Key in the amount you wish to pay. If you want the payment to reflect faster, choose the "Immediate Interbank Payment" option. This usually comes with a small fee but can significantly reduce the transfer time compared to a standard EFT, which can take up to 3 working days to reflect from another bank.

7. Review and Confirm: Double-check all the details you've entered - the beneficiary name, account number, amount, and especially your credit card number as the reference. A small mistake can cause delays or misallocated funds.

8. Authorize Payment: Confirm the payment, and you will likely need to authorize it using your Absa app's verification process (like a PIN or Approve-it message).

I remember the first time I had to pay a credit card from a different bank. I spent ages trying to figure out if I should use the 16-digit card number or an account number. After a quick call to Nedbank, they confirmed the account number for EFTs and told me to use the card number as the reference. It felt a bit confusing at first, but once I got it right, it became super easy.

Important Considerations for Your Payments

- Processing Times: While Absa offers immediate interbank payments, standard EFTs from another bank to Nedbank can take up to 3 business days to reflect. Always make your payments a few days before your due date to avoid late payment penalties.

- Proof of Payment: After making the payment, it's a good idea to save the proof of payment. Most banking apps or online platforms allow you to download or email this immediately.

- Automate Payments: To avoid forgetting, consider setting up a recurring payment or debit order from your Absa account to your Nedbank credit card. This way, you'll always pay on time.

Just last month, I almost forgot my Nedbank credit card payment! Luckily, I had set up a reminder on my phone, and I quickly used the Absa app to make an immediate payment. It saved me from a late fee, and I was so relieved to see it reflect on my Nedbank app within minutes.

By following these steps, you can easily manage your Nedbank credit card payments from your Absa account, keeping your finances in order and avoiding unnecessary stress.

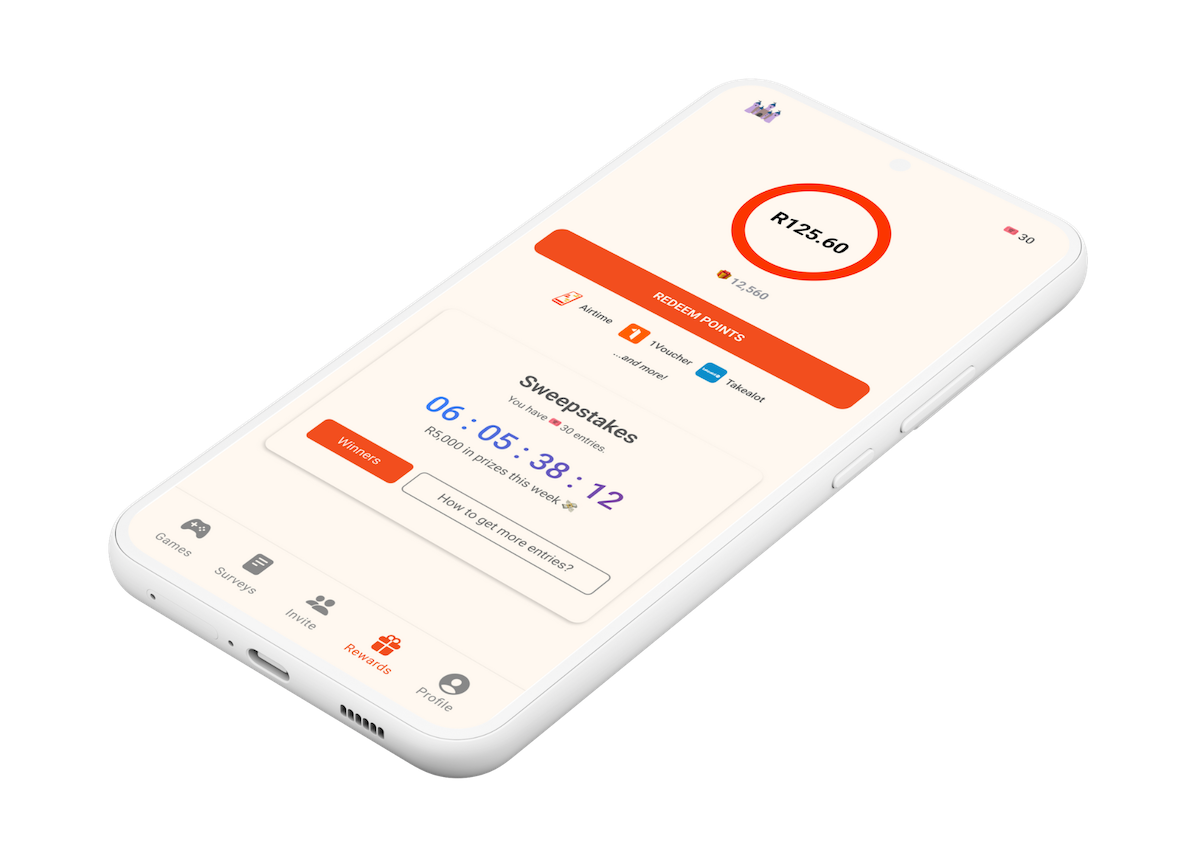

Did you know you can also earn rewards for everyday activities? Points Castle offers a fantastic way to get free vouchers and airtime, which can indirectly help you manage your finances and even lighten the load of some monthly expenses. Check out Points Castle to see how you can benefit!