How to Spot a Fake ABSA Proof of Payment

Getting an ABSA proof of payment can seem simple, but scammers are always finding new ways to trick people. It’s important to know what to look for so you don't get caught out.

The short answer is: to spot a fake ABSA proof of payment, always check the sender's account name and number, the recipient's details, the date and time, and look for any spelling errors or odd formatting. The best way to be sure is to confirm the funds have actually landed in your bank account, not just rely on the proof of payment itself.

Key Things to Check on an ABSA Proof of Payment

Spotting a fake proof of payment often comes down to paying attention to the small details. Here’s a list of things you should always check:

- Sender and Recipient Details:

- Account Names: Make sure the sender's name on the POP matches the person or company you're dealing with. The recipient's name should also be yours, exactly as it appears on your bank account.

- Account Numbers: Double-check both the sender's and receiver's account numbers. Even one wrong digit is a red flag.

- Bank Name: Confirm it clearly states "ABSA" and not a generic "Bank" or another bank.

- Transaction Information:

- Amount: Is the exact amount you are expecting shown on the proof of payment? Scammers might send a POP for a different, usually smaller, amount.

- Date and Time: Check when the payment was supposedly made. Does it match when they told you they sent it? Payments made after bank hours or on weekends might only reflect the next business day, so be mindful of those timings. For urgent payments, ABSA offers immediate payment options, but these usually come with a higher fee and clear indication. For more information on getting your own legitimate proof of payment, you can check out our guide on How to Get POP on the ABSA App.

- Look and Feel:

- Layout and Fonts: Official bank documents usually have a consistent look. If the fonts look off, are different sizes, or the layout seems messy, it's a warning sign.

- Spelling and Grammar: Banks have professional communication. Any typos or bad grammar on a proof of payment are huge red flags.

- Logos: Check the ABSA logo. Is it the correct, clear logo, or does it look blurry, stretched, or slightly different?

- Reference Number: Most official proofs of payment will have a clear reference number. While a scammer might include one, an absence is definitely suspicious.

I remember once I was selling a bicycle online. The buyer sent me an ABSA proof of payment that looked pretty convincing. But something felt a bit off. The font on the payment date looked a little different from the rest of the text. I decided to wait for the money to actually show up in my account before letting the bike go. Good thing I did, because the funds never arrived! It taught me a valuable lesson about trusting my gut and not just the paper (or PDF) in front of me.

Another common trick is when someone sends you a proof of payment and then pressures you to release goods or services immediately, saying they need it urgently or the bank is about to close. Don't fall for this. The pressure is often a tactic to make you overlook the details. Always verify the funds in your own bank account first. If you're ever in doubt, reach out to ABSA directly using their official contact channels, not any numbers provided on the suspicious proof of payment itself.

What to Do If You Suspect a Fake

If you think you've received a fake proof of payment, here's what to do:

1. Do Not Release Goods or Services: This is the most important step. Wait until you have confirmed the money is in your account.

2. Contact Your Bank: Reach out to your bank to verify if the payment is pending or has been received.

3. Report It: If it's a scam, report it to ABSA and, if necessary, to the police.

4. Block the Sender: Stop all communication with the person who sent the fake POP.

It's always better to be safe than sorry when it comes to your money. Always wait for the funds to clear in your bank account before completing any transaction.

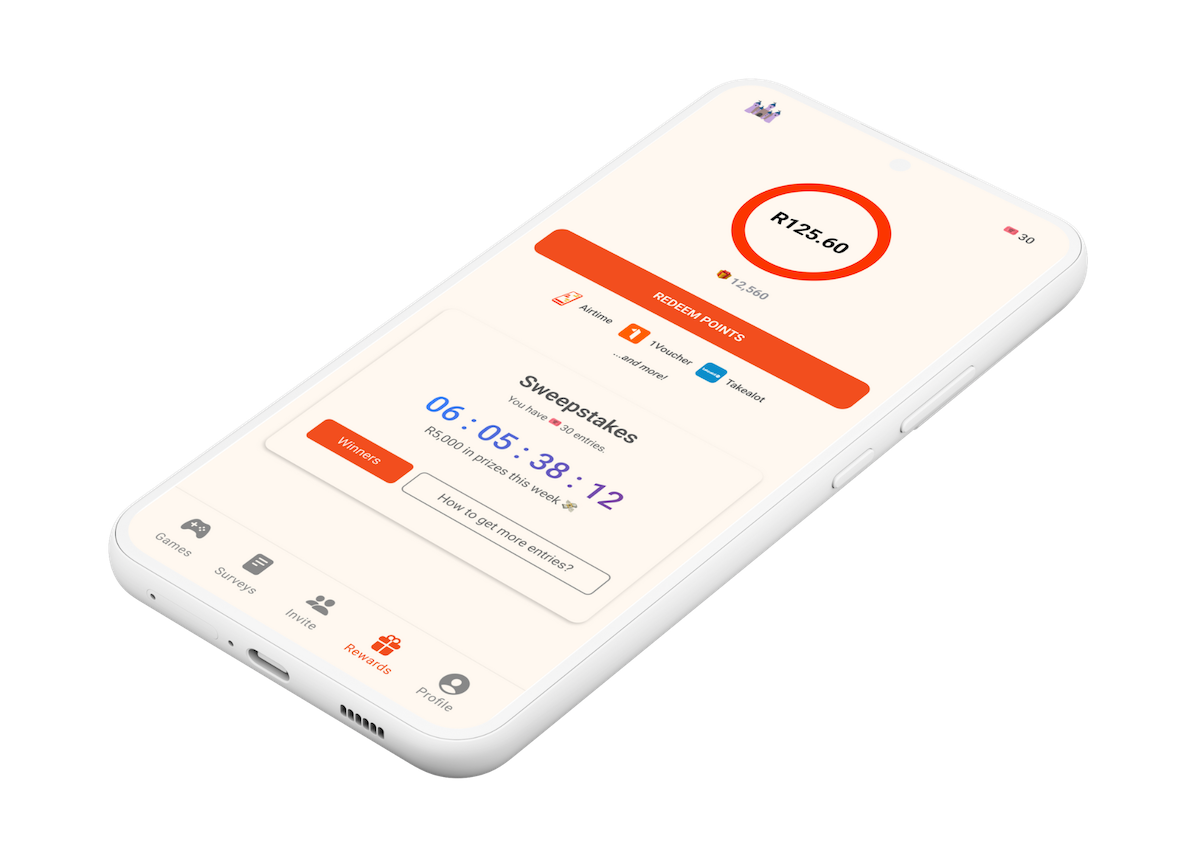

Did you know you can also get rewarded for everyday actions? Check out the Points Castle app where you can earn amazing rewards and even get free airtime.