What is a Bop Code for FNB?

Have you ever tried to send or receive money from another country using your FNB account? If so, you’ve probably been asked for something called a BOP code. It can sound a bit confusing at first, but it’s actually quite simple.

A BOP code, which stands for Balance of Payments code, is a three-digit number used to tell the South African Reserve Bank (SARB) the reason for an international payment. This is a requirement for all cross-border transactions. Think of it as a way of categorizing the money that comes into and goes out of South Africa.

For example, if you’re receiving money from a relative who lives overseas, you would use a specific BOP code for that. If you’re paying for goods you bought from an international online store, you’d use a different code. I remember the first time I had to do this; I was buying a gift for my cousin in the UK and got stuck on the FNB app, not knowing what to enter. A quick search online, and I found the right code for "gifts". It was a relief to know I was doing it correctly.

Common FNB BOP Codes

FNB has a list of BOP codes that you can use for different types of payments. Here are some of the most common ones:

- Gifts: If you’re sending or receiving money as a gift, you would use the code 401.

- Travel: For personal travel expenses, the code is 301.

- Salaries: If you are receiving a salary from an overseas employer, the code is 104.

- Goods: When paying for goods you've imported, you'll likely use a code in the 100s, like 101 for advance payments.

- Services: If you’re paying for a service from another country, like a subscription, the codes are usually in the 200s. I once had to pay a freelancer in another country for some design work, and I used a code from this category. It was surprisingly straightforward once I found the correct list of codes on the FNB website.

It is important to use the correct BOP code for your transaction. Using the wrong one can cause delays or even lead to your payment being rejected. If you are ever unsure which code to use, it is best to check the FNB website or contact their forex department for help. You can also find information about receiving money from overseas with other banks, like in this article about whether Capitec can receive money from overseas.

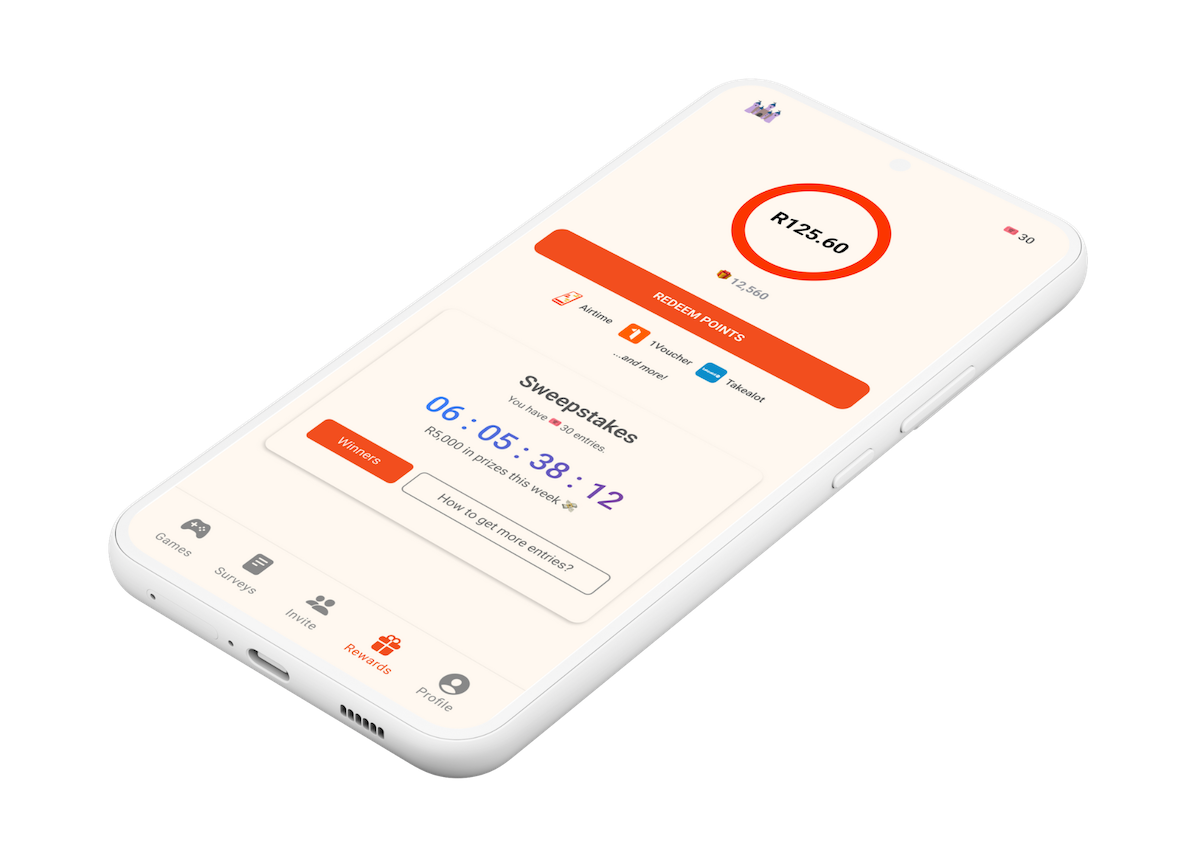

While sending and receiving money internationally can sometimes come with fees, did you know you can earn rewards for your everyday activities? With the Points Castle app, you can take surveys and play games to earn points that can be redeemed for a variety of vouchers. It’s a great way to get a little something extra back.