What is the Interest Rate on a Nedbank Credit Card?

Nedbank credit card interest rates can vary, but generally, they range from around 10.25% to 20.75%. The exact rate you get depends on your credit profile and the specific type of Nedbank credit card you have. Nedbank states that their latest interest rates were published on November 21, 2025, in line with the latest South African repo rate.

Knowing the interest rate on your Nedbank credit card is super important. It helps you understand how much extra money you might pay if you don't clear your balance each month. Nedbank offers different credit cards, and each can have a slightly different interest rate structure. For example, while some general Nedbank Credit Cards might have an interest rate of 20.75%, American Express Gold Credit Cards from Nedbank could be 18.25%. Platinum cards may also offer preferential debit interest rates.

Understanding Your Nedbank Credit Card Interest

When you get a Nedbank credit card, the interest rate you are offered is personalised. This means it’s based on things like your credit score. A good credit score tells the bank you're a lower risk, and they might offer you a better, lower interest rate. This can save you a good amount of money over time.

For instance, I remember applying for my first credit card a few years back. My credit history wasn't the strongest, so the interest rate I got was on the higher side. It really made me realise how important it is to keep a good credit record. Every time I paid my balance in full and on time, I could see my credit score slowly improving. It taught me a valuable lesson about responsible borrowing.

You also get up to 55 days interest-free on purchases made with your Nedbank credit card, as long as you pay the full balance before the due date on your statement. This is a great way to avoid paying any interest at all! To get the full 55 days, you need to make your purchase on the day your statement is generated, or soon after.

How Interest is Calculated

Credit card interest is usually calculated daily on your outstanding balance. If you don't pay your full balance by the due date, that interest starts adding up. The higher your outstanding balance, the more interest you'll pay.

Nedbank also mentions that if you switch to them, you might get a special balance transfer deal with a lower interest rate for a certain time, sometimes up to 12 months. This could be a good option if you have balances on other cards with high interest.

Another thing to remember is that the prime interest rate in South Africa affects all lending rates, including credit cards. Nedbank updates its interest rates based on changes to the South African repo rate. So, if the repo rate goes up, your credit card interest rate might also increase.

Just recently, I was chatting with a friend who was looking into consolidating some debt. She had a few store cards with really high interest rates. I told her to look into Nedbank's balance transfer options, explaining that even a few percentage points lower on her interest rate could make a big difference in her monthly payments and how quickly she paid off the debt. It's all about finding those small wins to manage your money better.

Managing your credit card wisely is key. Always try to pay more than the minimum payment, or ideally, the full outstanding balance, to save on interest. You can also monitor your statements closely to keep track of your spending and any fees. Speaking of fees, besides interest, Nedbank credit cards also have monthly service fees and credit facility fees which vary depending on the card type. For instance, a new Nedbank Gold Credit Card might have a monthly service fee from R60 and a credit facility fee from R20. You can find detailed pricing guides for 2026 on the Nedbank website.

Understanding how to manage your Nedbank credit card payments can help you save money. For more tips on managing your Nedbank credit card, you might find this article helpful: How to Pay My Nedbank Credit Card From Absa.

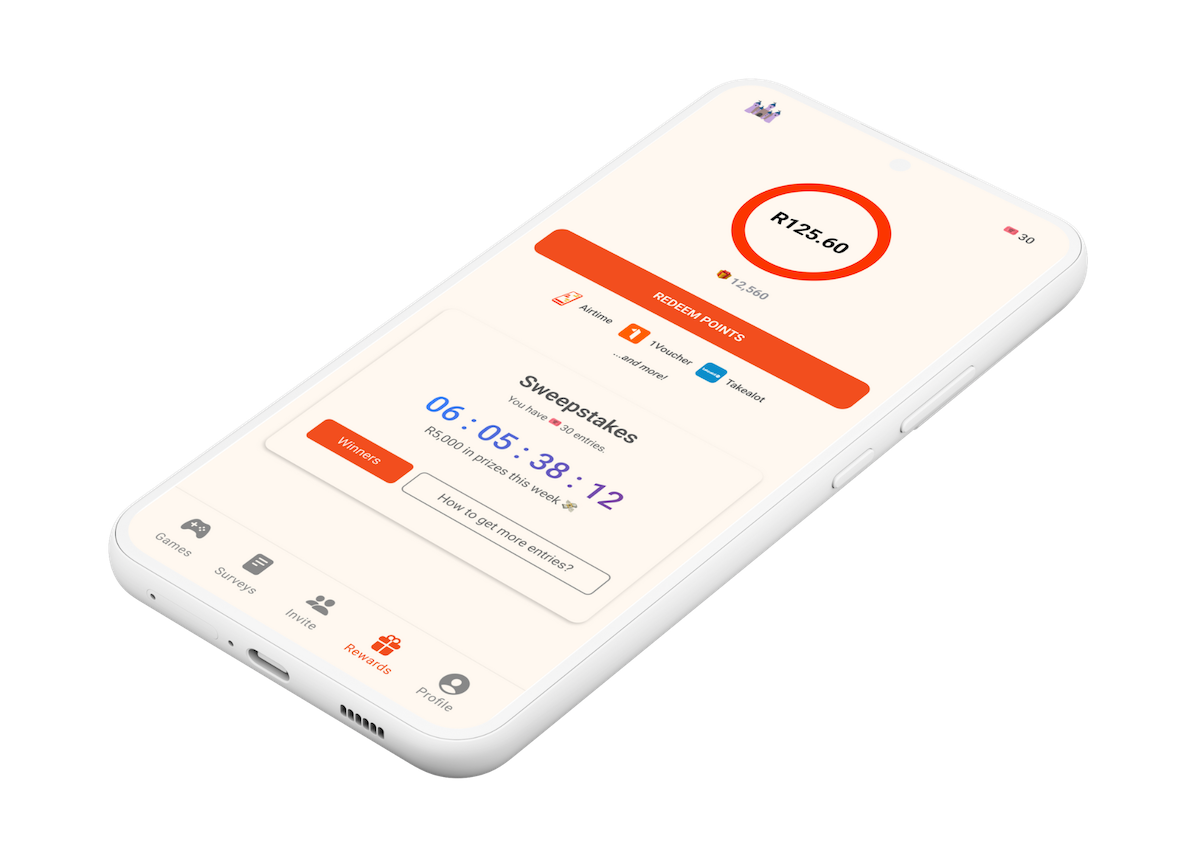

When you're smart about your money, you open up possibilities. Just like managing your credit card to pay less interest, you can also look for ways to earn more. Did you know the Points Castle App lets you earn free airtime and other rewards just by doing everyday things? It's a great way to get a little extra back.